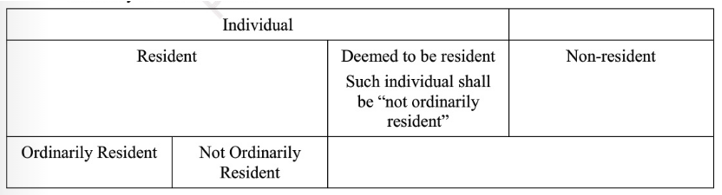

An individual may either be a:

(a) Resident in India; or

(b) Deemed to be Resident In India [Section 6(1 A)]; or

(c) Non-Resident in India.

An individual cannot simply be called a resident/deemed to be resident in India.

If he is a resident in India, we have to further determine whether he is:

(a) Resident And Ordinarily Resident in India; or

(b) Resident But Not Ordinarily Resident in India.

Further if an individual is deemed to be resident in India as per section 6(1 A), he shall be not ordinarily resident in India.

1. When an individual is said to be Resident In India?

An individual is said to be resident in India if he satisfies any one of the following two conditions:

Condition-1

| He is in India for a period or periods amounting in all to 182 days or more in the relevant previous year [Sub-clause (a)]; |

OR

Condition-2

| He is in India for 60 days or more during the relevant previous year and has been in India for 365 days or more during 4 previous years immediately preceding the relevant previous year [Sub-clause (b)]. |

Explanation 1: As per the Explanation, there are two exceptions to the above rule:

(a) In case of an individual, who is a citizen of India and who leaves India in any previous year for the purposes of employment outside India, the condition No. 2 supra (mentioned above) shall not be applicable for the relevant previous year in which he leaves India. In other words, for that particular previous year in which he leaves India for the purposes of employment outside India he shall be called resident only when he satisfies the condition No. 1 mentioned above.

Similarly, in case of an individual who is a citizen of India and who leaves India in any previous year as a member of the crew of an Indian ship, the condition No. 2 supra shall not be applicable.

(b) In the case of an individual—

— being a citizen of India, or a person of Indian origin within the meaning of Explanation to section 115C(e), who, being outside India, comes on a visit to India in any previous year, the provisions of above sub-clause (b) shall apply in relation to that year as if for the words “60 days”, occurring therein, the words “182 days” had been substituted;

and

— in case of such person having total income, other than the income from foreign sources, exceeding Rs. 15,00,000 during the previous year, for the words ‘60 days” occurring therein, the words “120 days” had been substituted;

However, as per section 6(6) discussed below, in case of the citizen or person of Indian origin having total income, (other than the income from foreign sources), exceeding Rs. 15,00,000 during the previous year, if he comes to India for a visit for 120 days but less than 182 days in the previous year, he shall be deemed to be not ordinarily resident in India (See para 4(C) below).

| Meaning of income from Foreign Sources [Explanation]

For the purpose of section 6, the expression ‘Income from foreign sources” means income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India) and which is not deemed to accrue or arise in India. |

In other words, a citizen of India or person of Indian origin, who had been in India for 365 days or more in the 4 preceding previous years and who undertakes a visit to India in any previous year, and

(a) whose total income other than income from foreign sources does not exceed Rs. 15,00,000 shall not be a resident in India if he stays in India upto 181 days in the relevant previous year; or

(b) whose total income other than income from foreign sources exceeds Rs.15,00,000 shall not be a resident in India ii he stays in India upto 119 days in the relevant previous year.

The moment he stays in India for 182 days or 120 days, as the case may he, he shall be treated as resident in India.

| 1. The above conditions, with exceptions / concessions may be called as category ‘A’ conditions.

2. A person is said to be of Indian origin if he, or either of his parents or any of his grandparents was born in undivided India i.e. before India was partitioned. [Explanation to section 115C(e)]. 3. In case of an individual, being a citizen of India a member of the crew of a foreign bound ship leaving India, the period or periods of stay in India shall, in respect of such voyage, be determined in the manner and subject to such conditions as may prescribed. [Explanation 2] |

Important Explanations

- Relevant previous year means the previous year for which the residential status is being determined.

- In computing the period of stay in India. it is not necessary that the stay should be for a continuous period. What is to be seen is the total number of day& stay in India during the relevant previous year.

- It is also not necessary that the stay should be only at one place, e.g.. he may stay at Bombay for 90 days and then go out of India. On return in the same previous year, he may stay at Delhi for 120 days during the same previous year. His total stay in India will be 210 days for that previous year.

- In computing the period of 182 days, the day the individual enters India and the day he leaves India should both he treated as stay in India.

- Place and purpose of stay in India is immaterial. Presence in territorial waters of India would also be regarded as presence in India.

Meaning of Employment: The term “employment” is not defined in the Income-tax Act.

A man may employ himself so as to earn profits in many ways. Thus, he can set up an independent practice abroad or businessman can shill his business activities to a foreign country. A person merely undertaking tours abroad in connection with his employment in India would not be eligible for the relaxation provided under exception 1.

2. Citizen of India shall be Deemed to be Resident In India in certain cases [Section 6(1A)]

Notwithstanding anything contained in section 6(1), an individual shall be deemed to be resident in India in the previous year if he satisfies all the following conditions:

(i) he is a Citizen of India,

(ii) he has total income, other than the income from foreign sources, exceeding Rs. 15 lakh during the previous year,

(iii) he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

| Explanation—For the removal of doubts, it is hereby declared that the above section 6(1A) shall not apply in case of an individual who is said to be resident in India in the previous year under section 6(1). |

In other words, where an individual, is a citizen of India, having total income, other than the income from foreign sources, exceeding l5 lakh during the previous year and he is not liable to pay tax in a foreign country due to his

(a) domicile, or

(b) residence, or

(c) criteria of similar nature

conditions of section 6(1) with explanation mentioned above shall not he applicable and he shall be deemed to be resident in India in all eases i.e. although he does not stay in India for even one day.

However, an Explanation has been inserted under section 6(1A) to clarify that section 6(1A) shall not apply in case of an individual who is said to be resident in India in the previous year under section

6(1) read with Explanation 1 under the said section. Therefore, if an individual satisfies any of the two conditions read with Explanation mentioned in section 6(1) above, section 6(1A) shall not apply in his case.

Further, as per Section 6(6) discussed in para 4(C) below, citizen of India who is deemed to be resident in India under section 6(1A) shall be treated as not ordinarily resident in India.

| 1. Meaning or ‘income from Foreign Sources’ [Explanation]

For the purpose of soc [ion 6, the expression “income from foreign sources” means income which accrues or arises outside India (except income derived from a business controlled in or a profssion set up in India) and which is not deemed to accrue or arise in India. 2. Meaning of term ‘Liable to Tax’ [Section 2(29A)] “liable to tax”, in relation to a person and with reference to a country, means that there is an income-tax liability on such person under the law of that country for the time being in force and shall include a person who has subsequently been exempted from such liability under the law of that country. Thus, if an individual is liable to tax under the law of a foreign country, section 6(1A) relating to deemed to be resident in India shall not be applicable. On the other hand. if he is not liable to tax in a foreign country, section 6(1A) relating to deemed to be resident in India shall become applicable provided the conditions mentioned in section 6(1A) are satisfied. However. in this case, he shall be nut ordinarily resident in India as per section 6(6). |

3. When an individual is said to be Resident But Not Ordinarily Resident in India? [Section 6(6)]

Section 6(6) states that an individual shall be Not Ordinarily Resident in India if he satisfies any

one of the following conditions:

(1) he has been a non-resident in India in 9 out of 10 previous years immediately preceding the relevant previous year, or he has been in India for a period of 729 days or less in 7 previous years immediately preceding the relevant previous year.

(2) He is a citizen of India. or a person of Indian origin, having total income, other than the income from foreign sources, exceeding Rs. 15 lakhs during the previous year, as referred to in clause (b) of Explanation 1 to section 6(1) [See the amendment above], who has been in India for a period or periods amounting in all to 120 days or more but less than 182 days; or

(3) He is a citizen of India who is deemed to be resident in India under section 6(1A) [See amendment above]

4. When an individual is said to be Resident And Ordinarily Resident In India?

Deriving from the above para 4(C), an individual who is resident in India, shall he resident and ordinarily resident in India in the following cases:

| He has been resident in India for at least 2 out of 10 previous years immediately preceding the relevant previous year.

This means that he must have satisfied any one of the conditions, with exceptions / concession (given above) for being a resident for at least 2 out of 10 previous years immediately preceding the relevant previous year, and he has been in India for 730 days or more, during seven previous years immediately preceding the relevant previous year. |

OR

| He is a citizen of India. or a person of Indian origin, having total income, other than the income from foreign sources, exceeding Rs.15 lakh during the previous year. and has been in India for a period or periods amounting in all to 120 days or more but less than 182 days; |

Further, an individual who is deemed to be resident in India shall be not ordinarily resident in India as per section 6(6)(d).

Notes :

| 1. An individual who is deemed to be resident in India as per section 6(1 A) shall be not ordinarily resident in India as per section 6(6)(b).

2. A citizen of India, or a person of Indian origin, having total income, other than the income from foreign sources, exceeding Rs.15 Lakhs during the previous year, as referred to in clause (b) of Explanation 1 to Section 6(1) (See the amendment above), who has been in India for a period or periods amounting in all to 120 days or more hut less than 182 days shall be resident but not ordinarily resident in India as per section 6(6)(c). |

5. When an individual is said to be Non-Resident In India [Section 2(30)]

An individual is said to be a non-resident, if he is not a resident in India i.e. none of the conditions (with exception/concession) mentioned in para 2.4a is satisfied.

The conditions for determining the residential status may be summarized as under:

(A) Conditions for determining whether an individual is Resident Or Not (Conditions of Category A)

| 1 | 2 | 3 | 4 |

| For individuals not covered under columns 2, 3 and 4. | For an Indian citizen who leaves India during the relevant previous year for the purpose of employment or as a member of the crew of an Indian Ship. | For an Indian citizen or a person, of Indian origin who being outside India, comes to visit India during the relevant previous year and his total income other than the income from foreign source does not exceed Rs. 15 Lakhs. | For an Indian citizen or a person, of Indian origin who being outside India, comes to visit India during the relevant previous year and his total income other than the income from foreign source exceeds Rs. 15 Lakhs. |

| (a) Must be in India for at least 182 days during the relevant previous year.

OR |

Must be in India for at least 182 days during the relevant previous year. | Must be in India for at least 182 days during the relevant previous year. | Must be in India for at least 182 days during the relevant previous year. |

| (b) Must be in India for at least 60 days during the relevant previous year and 365 days during 4 previous years immediately preceding the relevant previous year. | The condition No. 2 of Col. No. 1 will be of no significance because in view of the exception, the period of stay in India has been raised to 182 days. | This condition No. 2 of Col. 1 will be of no significance because in view of the exception, the period of stay in India has been raised to 182 days. | Must be in India for 120 days or more and less than 182 days during the relevant previous year and 365 days during 4 previous years immediately preceding the relevant previous year. |

(B) Conditions to be satisfied for being an Ordinarily Resident In India (Conditions of Category (B))

| Should be resident in India for at least 2 out of 10 previous years preceding the relevant previous year. |

AND

| Should be in India for at least 730 days during 7 years preceding the relevant previous year. |

If any or both of the above conditions of para B are not satisfied, he shall be said to be nor ordinary resident in India.

(C) Conditions to be satisfied for being Resident But Not Ordinarily Resident in India (Conditions of Category C)

(1) He has been a non-resident in India in 9 out of 10 previous years immediately preceding the relevant previous year or he has been in India for a period of 729 days or less in 7 previous years immediately preceding the relevant previous year; or

(2) He is a citizen of India, or a person of Indian origin, having total income. other than the income from foreign sources, exceeding Rs. 15 Lakh during the previous year, as referred to in clause (b) of Explanation 1 to Section 6(1) [See the amendment above], who has been in India for a period or periods amounting in all to 120 days or more but less than 182 days; or

(3) He is a citizen of India who is deemed to be resident in India under Section 6(1A) [See amendment above]

Illustration – 1:

Rickey Pouting, an Australian cricketer has been coming to India for 100 days every year since 2008-09:

(a) Determine his residential status for the assessment year 2022-23.

(b) Will your answer be different if he has been coming to India for 110 days instead of 100 days every year?

Solution :

(a) Rickey Ponting satisfies the second condition of category A because he is in India for more than 60 days during the relevant previous year and for 400 days during four years preceding the relevant previous year. Therefore, he is a resident.

Further, in this case, although he satisfies the first condition of category B of being resident for at least 2 out of 10 preceding previous years but he does not satisfy the second condition of category B as during 7 years preceding the previous year, he is in India for only 700 days. He shall, therefore, be a resident but not ordinarily resident in India.

(b) Yes. He will, in this case, be resident and ordinarily resident in India. He satisfies both conditions of category ‘B’ as he was in India for 770 days in the last seven years and he was resident for at least 2 previous years out of 10 previous years immediately preceding the relevant previous year.

Illustration – 2:

‘R’, an Indian citizen left India for the first time on 21.9.2021 for employment in Germany. During the previous year 2022-23 he comes to India on 5.5.2022 for 150 days. Determine (he residential status of ’R’ for assessment years 2022-23 and 2023-24.

Solution:

During the previous year 2021-22 ‘R’ was in India for 174 days (30 + 31+30+31+31+21) (i.e. 1.4.2021 to 21.9.2021) and therefore, does not satisfy the first condition. The second condition is not applicable in his case, as he is a citizen of India and leaves India in 2021-22 for employment abroad.

He is therefore, Non-Resident in India.

Similarly. during the previous year 2022-23, he visits India for 150 days. In this case also, second condition is not applicable as he is a citizen of India and has come to India for a visit. Therefore, he will be a Non-Resident in India even for previous year 2022-23.

Illustration -3 :

‘A’, a citizen of India left India on 6.6.2008 for employment abroad. He did not come to India upto previous year 2018-19. During 2019-20 and 2020-21, he visited India for 145 days and 195 days respectively. In the previous year 2021-22 he came to India on 7.4.2021 and left on 30.11.2021. Determine his residential status for assessment year 2022-23.

Solution:

Category ‘A’ conditions.

Previous year 2021-22: Stay in India is for 238 days (24 + 31 + 30 + 31 + 31 + 30 + 31 + 30) (i.e. 7.4.2021 to 30.11.2021). He is, therefore, Resident in India.

Category ‘B’ conditions

| Previous Year | No. of Days’ Stay | Resident / Non-Resident |

| 2020-21 | 195 | Resident |

| 2019-20 | 145 | Non-Resident |

As he is a citizen of India and visits India during the previous year’s 2020-21 and 2019-20, second condition will not be applicable in his case for the previous year 20 19-20. Prior to that he did not visit India after he left on 6.6.2008.

As he is resident only for one previous year, out of 10 preceding previous years (i.e. previous years 201 1-12 to 2020-21), he does not satisfy the first condition of category (B) i.e. being resident in at least 2 out of 10 previous years immediately preceding the relevant previous year.

There is no need to see the second condition of Category (B) as the first condition itself is not satisfied.

He, is therefore, “Not Ordinarily Resident in India”.

![Residential Status [Sections 5 to 9B]](https://incometaxmanagement.in/wp-content/uploads/2023/09/Residential-Status-Sections-5-to-9B-1024x683.jpg)

![EXEMPTED INCOMES [Section – 10, 10AA, 11 to 13A]](https://incometaxmanagement.in/wp-content/uploads/2023/09/Exempted-Incomes-Section-10-1024x683.jpg)

![Income of an Electoral Trust shall be Exempt [Section 13B]](https://incometaxmanagement.in/wp-content/uploads/2023/10/61-Exempted-Incomes-Section-13B-1024x683.png)

![Incomes of Political Parties [Section-13A]](https://incometaxmanagement.in/wp-content/uploads/2023/10/60-Exempted-Incomes-Section-13A-1024x683.png)

![Special Provisions in respect of Newly-established Units in Special Economic Zones (SEZ) [Section-10AA]](https://incometaxmanagement.in/wp-content/uploads/2023/10/59-Exempted-Incomes-Section-10AA-1024x683.png)

![Exemption in respect of income chargeable to Equalization Levy [Section 10(50)]](https://incometaxmanagement.in/wp-content/uploads/2023/10/58-Exempted-Incomes-Section-1050-1024x683.png)

![Income of a Developmental Financing Institution (DFI) to be Exempt [Section 10(48E)]](https://incometaxmanagement.in/wp-content/uploads/2023/10/57-Exempted-Incomes-Section-1048E-1024x683.png)