Under Section 56(2)(ib) of the Indian Income Tax Act, 1961, income from winnings is subject to taxation. This includes income from lotteries, crossword puzzles, horse races, and card games. In this article, we will explore the taxability of such income and the relevant provisions under the Income Tax Act.

Section 56(2)(ib) of the Income Tax Act addresses the taxation of specific kinds of income, which are categorized as “Income from Other Sources.” This section pertains to the income earned from the following sources:

1. Winnings from Lotteries:

Any income earned from winnings in lotteries, whether state or non-state lotteries, is considered taxable under Section 56(2)(ib).

Lotteries are a popular form of gambling in India. If you are lucky enough to win a lottery, the winnings will be considered as income and subject to taxation. The income tax rate applicable to lottery winnings is determined based on the individual’s income slab. The winnings are added to the individual’s total income and taxed accordingly.

2. Winnings from Crossword Puzzles:

Income earned from winning crossword puzzles, game shows, or any similar contests is also subject to taxation under this section.

Crossword puzzles are another form of gambling where individuals can win cash prizes. Similar to lotteries, the income from crossword puzzle winnings is taxable. The winnings are treated as income and added to the individual’s total income for the year. The income tax rate applicable will depend on the individual’s income slab.

3. Winnings from Horse Races:

Winnings from horse races, including income derived from betting on horse races, fall under the purview of this section.

Horse racing is a popular sport in India, and individuals can place bets on horses. If you are lucky enough to win a bet at a horse race, the winnings are subject to taxation. The income tax rate applicable to horse race winnings is determined based on the individual’s income slab. The winnings are added to the individual’s total income and taxed accordingly.

4. Winnings from Card Games:

Income from winnings in card games, including games like poker or rummy played in any casino, club, or similar establishments, is taxable as well.

Card games such as poker, rummy, and blackjack are also forms of gambling. If you win a significant amount of money playing card games, the winnings are considered as income and subject to taxation. The income tax rate applicable to card game winnings is determined based on the individual’s income slab. The winnings are added to the individual’s total income and taxed accordingly.

Key Point of Taxability of Section 56(2)(ib)

Key points regarding the taxability of such income under Section 56(2)(ib) are as follows:

Rate of Tax:

The income earned from the sources mentioned above is taxed at a flat rate of 30% (plus applicable surcharge and cess) as of my last knowledge update. This tax is deducted at source (TDS) by the payer if the winnings exceed a specified threshold.

Threshold for TDS:

The threshold limit for TDS on these winnings may vary depending on the type of game or activity. For example, for horse races, TDS is applicable if winnings exceed Rs. 10,000 in a single race. The specific thresholds should be checked in the latest tax rules.

Reporting:

Taxpayers are required to report such income in their income tax returns and disclose the details of their winnings from lotteries, crossword puzzles, horse races, or card games.

No Deduction Allowed:

Under Section 58(4), no deduction for any expenditure or allowance is allowed against income taxable under Section 56(2)(ib).

Exemptions:

Certain winnings from authorized state lotteries may be exempt from taxation under Section 10(34) and Section 10(34A) of the Income Tax Act. However, specific rules and exemptions may apply and can change with amendments to the tax laws.

Penalties:

Non-compliance with tax regulations, including the provisions of Section 56(2)(ib), can result in penalties and legal consequences.

Tax Deduction at Source (TDS)

It is important to note that tax deduction at source (TDS) is applicable to income from winnings. If the winnings exceed a certain threshold, the payer is required to deduct TDS at the applicable rate before making the payment. The individual receiving the winnings will then receive the net amount after deducting TDS. The TDS amount deducted can be claimed as a tax credit while filing the income tax return.

Special rate of Income-Tax in case of Winnings from Lotteries, Crossword Puzzles, Races, etc. [Section 115BB]

Although, winnings from lotteries, etc. is part of total income of the assessee, such income is taxable at a special rate of Income-tax, which at present, is 30% + surcharge, if applicable + health and education cess 4%.

Deduction of any expenses, allowance or loss not allowed from such winnings: According to section 58(4), no deduction in respect of any expenditure or allowance, in connection with such income, shall be allowed under any provision of the Income-tax Act. However, expenses relating to the activity of owning and maintaining race horses are allowable.

In other words, the entire income of winnings, without any expenditure or allowance, will be taxable. In fact, deduction under sections 80C to 80U discussed later in the Chapter on Deductions from Gross Total Income will also not be available from such income although such income is a part of the total income.

As lottery income is taxed at flat rate, the basic exemption of income (say Rs. 2,50,000) is not available to the assessee.

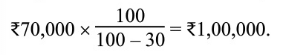

Grossing up of lottery income, etc.

As in the case of some other incomes, there is also a provision for tax to be deducted at source from income from winning of lotteries, horse races and crossword puzzles. The rate of TDS in the case of such incomes is 30% if the income exceeds Rs. 10,000. Such tax deducted at source is income and the amount received is net income after deduction of tax at source. In this case, such net income will have to be grossed up as under:

If a person wins a lottery of Rs. 1,00,000, tax must have been deducted @ 30% and net amount received by the assessee would be Rs. 70,000 (1,00,000 – 30,000).

Grossing up would be done as:

Conclusion

Income from winnings from lotteries, crossword puzzles, horse races, and card games is subject to taxation under Section 56(2)(ib) of the Indian Income Tax Act, 1961. The income tax rate applicable will depend on the individual’s income slab. It is important to keep track of such winnings and ensure compliance with the income tax provisions. Additionally, TDS may be applicable if the winnings exceed a certain threshold, and the net amount received after deducting TDS can be claimed as a tax credit.

![[Section 56(2)]: List of Incomes included under ‘Income from Other Sources’](https://incometaxmanagement.in/wp-content/uploads/2023/09/Specific-Incomes-Includes-Section-562-1024x683.png)