Section 49 specifies how the cost of acquisition of a capital asset is determined when it is acquired through certain non-purchase modes, such as inheritance, gift, will, distribution on liquidation, or transfer under a revocable/irrevocable trust.

Key Provisions of Section 49

1. Assets Acquired Without Direct Purchase [Section 49(1)]

When a capital asset is acquired in any of the following ways, the cost of acquisition is taken as the cost to the previous owner:

- By inheritance(from a legal heir or successor).

- By gift(from relatives or others).

- Under a will or through succession.

- By distribution of assets on liquidation of a company.

- Under a revocable/irrevocable transfer(e.g., family trust).

- On any distribution of assets under a partition of HUF (Hindu Undivided Family).

- Under a transfer covered under Section 47(iv), (v), (vi), or (via)](e.g., transfer to a partnership firm, LLP, or amalgamation).

Example:

- If your father bought a property for ₹20 lakh in 2005 and gifted it to you in 2020, your cost of acquisition= ₹20 lakh (indexed for inflation if held long-term).

2. Indexation Benefit [Section 49(2A)]

- If the asset was held long-termby the previous owner, the cost can be indexed from the year of acquisition by the previous owner.

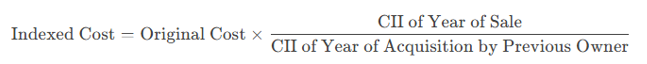

Indexation formula:

(CII = Cost Inflation Index)

Example:

- If the previous owner bought a property in 2005-06 (CII = 117)for ₹20 lakh and you sell it in 2024-25 (CII = 348), the indexed cost = ₹20 lakh × (348/117) ≈ ₹59.48 lakh.

3. Special Cases

(a) Assets Acquired Before 1st April 2001 [Section 49(1) + Section 55(2)(b)]

- The taxpayer can choose between:

- Actual cost to the previous owner, or

- Fair Market Value (FMV) as of 1st April 2001(whichever is higher).

(b) Self-Generated Assets (Goodwill, Trademarks, etc.) [Section 55(2)(a)]

- Deemed cost = Nil(unless purchased).

(c) Bonus/Rights Shares [Section 55(2)(aa)]

- Bonus shares issued after 1st April 2001: Cost = Nil.

- Bonus shares issued before 1st April 2001: Can use FMV as of 1st April 2001.

(d) Depreciable Assets (Section 50)

- Deemed cost = Written Down Value (WDV)of the asset block.

- Tax Treatment: Always short-term capital gains (STCG).

4. Importance of Section 49

- Prevents double taxationby considering the original owner’s cost.

- Ensures fair computationof capital gains in cases of inheritance/gifts.

- Allows indexation benefitto account for inflation.