Section 195A of the Income Tax Act, 1961, governs scenarios where the payer agrees to bear the tax liability on income payable to a recipient, requiring the income to be “grossed up” to ensure the recipient receives the agreed net amount after tax deduction. Below is a detailed breakdown:

1. Applicability of Section 195A

✅ Covered Cases:

- Applies when the payer agrees to bear the taxon income subject to TDS (e.g., fees, royalties, interest) under Chapter XVII (Sections 192 to 195).

- Excludes salary paymentscovered under Section 192(1A).

❌ Exemptions:

- Salary income (handled under Section 192).

- Payments where the recipient bears the tax liability.

2. Key Mechanism: “Grossing Up”

- Calculation: The payable amount is increased so that after TDS deduction, the recipient receives the agreed net amount.

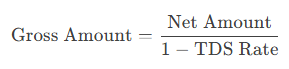

Formula:

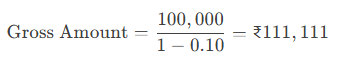

- Example: If ₹100,000 is payable net of tax (TDS rate: 10%):

TDS (10%): ₹11,111 → Net Payment: ₹100,000 .

3. Compliance Requirements

- TDS Deduction: Payer must deduct tax on the grossed-up amount.

- Deposit & Reporting:

- Deposit TDS by the 7th of the next monthvia Challan 281.

- File Form 26Q(residents) or Form 27Q (non-residents) quarterly.

- Certificate Issuance: Provide Form 16Ato the payee, even if tax is borne by the payer.

4. Penalties for Non-Compliance

- Late Deduction/Payment: Interest @ 1%–1.5% per month.

- Non-Issuance of Form 16A: Penalty up to ₹1 lakh.

5. Key Takeaways

🔹 Grossing Up: Ensures the recipient receives the agreed net amount after TDS.

🔹 Form 16A Mandatory: Even if tax is borne by the payer.

🔹 Exclusions: Salary payments (Section 192) and non-taxable income.