The Income Tax Act, 1961, provides a special procedure for assessments in search cases to ensure thorough scrutiny of undisclosed income. Below is a detailed breakdown of the process under Sections 153A, 153B, 153C, and 153D:

1. Section 153A: Assessment in Case of Search or Requisition

Applicability

- Triggered when a search is conducted under Section 132or requisition is made under Section 132A.

- Covers 6 previous assessment years + the current year(total 7 years).

Key Steps

- Notice Issuance

- The Assessing Officer (AO) issues a notice requiring the taxpayer to file returns for the relevant 6 years + current year.

- The taxpayer must file returns even if original assessments were already completed.

- Abatement of Pending Assessments

- Any pending assessments for the 6-year period abate(stand terminated) upon search initiation.

- If earlier assessments are annulled in appeal, they reviveunless the annulment is overturned.

- Scope of Assessment

- The AO can reassess total incomefor all 7 years.

- For completed assessments, additions can onlybe made based on incriminating material found during the search.

- Tax Rates

- Tax is charged at rates applicable to the respective assessment years(not necessarily as “undisclosed income”).

2. Section 153B: Time Limits for Completion of Assessment

Time Frame

- 21 monthsfrom the end of the financial year in which the last search authorization was executed.

- Extended to 33 monthsif the case involves foreign transactions or Transfer Pricing (TPO reference).

For Third Parties (Section 153C Cases)

- 21 monthsfrom the end of the FY of search OR

- 9 monthsfrom the date seized material is handed over to the AO, whichever is later 7.

3. Section 153C: Assessment of Other Persons

When Applicable?

- If seized material (cash, jewellery, documents) belongs to a third party(not the searched person).

Procedure

- The AO hands over materialto the jurisdictional AO of the third party.

- The third party is issued a notice under Section 153Aand assessed similarly (6 years + current year).

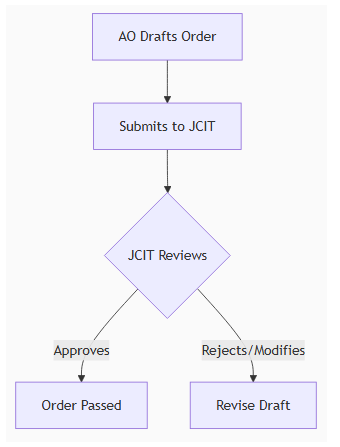

4. Section 153D: Prior Approval for Assessment Orders

Mandatory Approval

- No assessment order can be passed by an AO below the rank of Joint Commissionerwithout prior approval from a Joint Commissioner or higher authority.

Judicial Safeguards

- Approval must involve application of mind; mechanical/rubber-stamp approvalsinvalidate the assessment.

- Example: Bulk approval of 85 cases in one daywas held invalid by courts.

5. Summary of Key Differences

| ASPECT | SECTION 153A | SECTION 153B | SECTION 153C | SECTION 153D |

| Trigger | Search/Requisition | Time limits for assessment | Seized material belongs to third party | Approval for assessment orders |

| Assessment Years | 6 previous + current | N/A | Same as 153A | N/A |

| Time Limit | N/A | 21/33 months | 21 months or 9 months (whichever later) | N/A |

| Key Requirement | Incriminating material for completed assessments | Compliance with deadlines | Proof of ownership by third party | Prior approval from JCIT |

6. Practical Implications

- For Taxpayers:

- Ensure proper documentationto explain seized assets.

- Challenge mechanical approvalsor lack of incriminating evidence in assessments.

- For Tax Authorities:

- Follow strict timelinesunder Section 153B.

- Avoid perfunctory approvalsunder Section 153D to prevent legal invalidation.

- For Legal Advisors:

- Focus on incriminating material linkagein 153A cases.

- Argue abatement revivalonly if annulment is set aside

1. Notice for Filing Return Under Section 153A(1)(a)

Key Provisions

- Trigger for Notice:

- Issued when a search is conducted under Section 132or requisition is made under Section 132A

- Applies to both the searched person and third parties (under Section 153C)

- Scope of Notice:

- Requires filing returns for:

- The current assessment year(year in which search occurs)

- 6 immediately preceding assessment years

- Total coverage: 7 assessment years

- Mandatory Compliance:

- Taxpayer must file returns even if:

- Original assessments were already completed

- No incriminating material was found for certain years

- Returns were already filed for those years

- Taxpayer must file returns even if:

- Time Limit for Issuance:

- No specific statutory deadline for issuing notice

- But assessment must be completed within time limits under Section 153B

Practical Implications

- For Taxpayers:

- Must file fresh returns for all 7 years

- Can revise previously filed returns

- Should disclose all income (including any undisclosed income found during search)

- For Assessing Officers:

- Must issue notice in writing

- Should specify all relevant assessment years

- Must allow reasonable time (typically 30 days) for compliance

- Consequences of Non-Compliance:

- Best judgment assessment under Section 144

- Penalty proceedings under Section 271F (up to ₹10,000)

- Possible prosecution in severe cases

Judicial Precedents

- Mandatory Nature:

- Courts have held issuance of notice as mandatory (CIT v. Kabul Chawla)

- No assessment possible without first issuing notice

- Scope of Assessment:

- For already completed assessments, additions can only be made based on incriminating material (All Cargo Logistics case)

- Validity Challenges:

- Notice can be challenged if:

- Issued without valid search

- Covers periods beyond 6 years

- Lacks proper authorization

- Notice can be challenged if:

Procedural Aspects

- Format of Notice:

- Typically uses Form ITNS 153A

- Must specify all assessment years covered

- Response Options:

- File original/revised returns

- Request extension if needed

- Challenge notice if malafide

- Subsequent Assessment:

- AO examines all filed returns

- Can make additions based on:

- Search findings

- Other material information

- Must follow principles of natural justice

Comparison with Regular Assessment

| FEATURE | REGULAR ASSESSMENT | SECTION 153A ASSESSMENT |

| Trigger | Annual filing | Search/requisition |

| Years | Current year only | 6 previous + current |

| Notice | Section 142(1) | Section 153A(1)(a) |

| Time Limit | Normal assessment deadlines | 21/33 months from search |

| Scope | Routine examination | Comprehensive scrutiny |

2. Assessment in Case of Search or Requisition [Section 153A(1)(b)]

Section 153A of the Income Tax Act, 1961 governs assessments in cases where a search is initiated under Section 132 or books/documents/assets are requisitioned under Section 132A. This section overrides several other provisions in the Act (such as Sections 139, 147, 148, 149, 151, and 153) to provide a specialized procedure for such cases.

1. Legal Framework

Section 153A(1)(b) mandates a comprehensive assessment process when:

- A search is conducted under Section 132, or

- Assets are requisitioned under Section 132A

2. Key Features

A. Assessment Scope

- Covers 6 previous assessment years + current year(total 7 years)

- Applies even if regular assessments were already completedfor those years

- For completed assessments:

- Can only make additions based on incriminating materialfound during search

- Cannot reopen purely on suspicion (All Cargo Logistics Ltd. ruling)

B. Special Provisions

- Abatement of Pending Proceedings

- Any pending assessments/appeals for the 6-year period abate automatically

- Exception: If assessment was completed but later annulled in appeal

- Assessment Methodology

- AO must consider:

- Search findings

- Regular books of account

- Any other material information

- Must follow principles of natural justice(proper hearing, disclosure of evidence)

- AO must consider:

- Tax Computation

- Normal tax rates apply (not necessarily Section 115BBE rates)

- Undisclosed income may attract higher taxes + penalties

3. Procedural Aspects

A. Notice & Compliance

- Notice issued under Section 153A(1)(a)precedes assessment

- Taxpayer must file returns for all 7 years

- AO examines returns and makes assessment order

B. Time Limits

- Governed by Section 153B:

- Normal cases: 21 monthsfrom FY-end of search

- Foreign transactions/TP cases: 33 months

C. Documentation Required

- Search seizure memos (Panchnama)

- Statements recorded during search

- Evidence of undisclosed income

- Taxpayer’s explanations

4. Judicial Safeguards

A. Valid Search Condition

- Assessment under 153A requires lawful search/requisition

- Illegal searches invalidate proceedings (Manish Maheshwari case)

B. Incriminating Material Requirement

- For completed assessments:

- No addition without search-found evidence

- Mere change of opinion not valid (ABC Ltd. v. ACIT)

C. Approval Mechanism

- Assessment order requires prior approvalunder Section 153D

- Rubber-stamp approvals invalid (CIT v. Sinhgad Technical Education Society)

5. Practical Implications

For Taxpayers:

- Must disclose all income (including search findings)

- Can claim deductions/benefits as per normal provisions

- Should maintain proper documentation

For Revenue:

- Must establish nexus between seized material and additions

- Should complete assessments within time limits

- Must follow due process

6. Comparison with Regular Assessment

| PARAMETER | REGULAR ASSESSMENT | 153A ASSESSMENT |

| Trigger | Annual filing | Search action |

| Years | 1 year | 7 years |

| Evidence Standard | Routine examination | Incriminating material |

| Time Limit | Normal deadlines | 21/33 months |

| Approval Needed | No | Yes (153D) |

7. Recent Judicial Trends

- No Fishing Enquiries:

- AO cannot make roving inquiries beyond search material (PCIT v. Abhisar Buildwell)

- Partial Assessments Valid:

- Can assess some years even if no material for others

- Revised Returns:

- Can be filed in response to notice

8. Common Disputes & Resolutions

A. Validity Issues

- Challenge if:

- Search was invalid

- Time limit expired

- No incriminating material

B. Quantum Disputes

- On valuation of seized assets

- On nature of income (business/capital)

C. Penalty Matters

- Whether concealment was willful

9. Strategic Considerations

- For Taxpayers:

- Early engagement with tax authorities

- Proper documentation of explanations

- Consider settlement options where applicable

- For Practitioners:

- Scrutinize search validity

- Verify evidence linkage

- Monitor time limits

10. Conclusion

Section 153A(1)(b) creates a special assessment regime that:

- Significantly expands revenue’s powers

- Provides structured assessment process

- Incorporates taxpayer safeguards

- Balances enforcement needs with rights protection

Proper understanding of its provisions is essential for:

- Compliant taxpayers to protect their interests

- Revenue authorities to make legally sustainable assessments

- Advisors to provide effective representation

3. Separate Assessment of 6 Years + Current Year Under First Proviso to Section 153A

1. Core Provision

The first proviso to Section 153A mandates:

“The assessment or reassessment… shall be made for each assessment year separately”

This requires:

- Individual assessment orders for each of the 6 preceding years

- Plus current year(year of search)

- No clubbingof multiple years in one order

2. Key Implications

A. Year-Wise Scrutiny

- Each year’s income computed independently

- Must establish year-specifictax liability

- No set-offof losses across these years

B. Evidence Requirement

- For completed assessments:

- Need year-specific incriminating material

- Cannot apply findings from one year to another

C. Procedural Compliance

- Separate:

- Notices

- Assessment orders

- Demand notices

- Appeal processes

3. Example:

Suppose a search is conducted on 15 July 2025. The AO can assess:

- AYs 2019–20 to 2024–25 (6 years preceding AY 2025–26),

- AY 2025–26 (year of search),

- And possibly AYs 2015–16 to 2018–19 (if conditions for extending to 10 years are met).

Each year will have its own assessment order, based on incriminating material found during the search

4. Practical Implementation

For Assessing Officers:

- Documentation

- Maintain separate files per assessment year

- Tag evidence to specific years

- Order Drafting

- Repeat facts but analyze year-wise

- Avoid copy-paste reasoning

- Approvals

- Obtain separate 153D approvalsper year

For Taxpayers:

- Return Filing

- Submit year-specific disclosures

- Claim deductions separately

- Defense Strategy

- Challenge non-year-specific additions

- Demand evidence linkage

5. Common Errors & Remedies

| ERROR | CORRECTION |

| Single order for multiple years | Pass separate orders |

| Generic reasoning | Year-specific analysis |

| Common demand notice | Issue individual notices |

| Cross-year adjustments | Treat each year distinctly |

6. Recent Developments

- Digital Compliance

- Now possible to file/submit documents year-wise on IT portal

- CBDT Instructions

- Emphasizes strict adherence to proviso

- Warns against consolidated orders

- Judicial Trends

- Tribunals quashing omnibus assessments

- Stricter scrutiny of year-wise compliance

7. Strategic Considerations

A. For Revenue

- Allocate sufficient time for 7 assessments

- Train officers on year-wise documentation

B. For Taxpayers

- Maintain year-wise books

- Seek certified copies of year-tagged evidence

C. For Practitioners

- Verify each year’s assessment completeness

- File separate appeals if needed

8. Comparison with Other Provisions

| FEATURE | REGULAR ASSESSMENT | 153A ASSESSMENT |

| Order Scope | Single year | 7 separate orders |

| Evidence | General inquiry | Year-specific material |

| Timeframe | 12-21 months | 21/33 months from search |

4. Prior Approval for Search Assessments [Section 153D]

Section 153D of the Income Tax Act, 1961, mandates that no order of assessment or reassessment in cases of search or requisition (covered under Sections 153A or 153C) can be passed by an Assessing Officer below the rank of Joint Commissioner without obtaining prior approval from a Joint Commissioner or higher authority for each assessment year.

1. Statutory Mandate

Section 153D imposes a mandatory pre-assessment approval requirement:

“No order u/s 153A/153C shall be passed without prior approval of Joint Commissioner or higher”

2. Key Operational Aspects

A. Approval Hierarchy

| AUTHORITY LEVEL | DESIGNATION |

| Minimum | Joint Commissioner |

| Higher Options | Commissioner/PCIT/DGIT |

B. Document Checklist

- Draft assessment order

- Incriminating evidence summary

- Tax computation sheets

- Legal issue memorandum (if complex)

C. Process Flow

3. Practical Compliance Matrix

For Assessing Officers:

- Pre-Submission Audit

- Verify arithmetic accuracy

- Confirm evidence linkage

- Check time limit compliance

- Approval Package

- Prepare concise note covering:

- Search legality

- Year-wise additions

- Judicial precedents

- Prepare concise note covering:

For Tax Professionals:

- Defense Strategies

- Seek approval details via RTI

- Challenge if:

- Bulk approvals (e.g., >5 cases/day)

- No modification suggestions

- Generic approval wording

- Appeal Grounds

- “Failure of JCIT to discharge quasi-judicial function”

- “Non-application of mind evident from…”

4. Recent Enforcement Trends

- CBDT Directives (2023)

- Mandates:

- Approval register maintenance

- Monthly reporting of approval stats

- Special monitoring of high-value cases

- Tech Integration

- ITBA system now:

- Flags non-compliant orders

- Tracks approval timelines

- Auto-generates approval memos

5. Risk Management

Taxpayer Risks:

- Untimely challenges (statute limits)

- Incomplete approval records

Department Risks:

- Mass approval practices

- Delegation to unauthorized officers

6. Strategic Recommendations

For Revenue:

- Implement three-eye principle(AO/Reviewer/JCIT)

- Conduct quarterly approval audits

For Practitioners:

- Include approval challenge in first appeal itself

- Maintain JCIT approval database(patterns/tendencies)

5. Third Proviso to Section 153A (1): Exception for Notified Cases

The third proviso to Section 153A(1) of the Income Tax Act, 1961, provides an exception where the Assessing Officer (AO) may not issue notices for six preceding assessment years in certain notified cases. This provision is designed to limit unnecessary assessments in specific scenarios, such as election-related seizures or cases where no evidence exists for prior years.

Key Conditions for Exemption

The third proviso applies if:

- Search/Requisition During Elections:

- The search under Section 132or requisition under Section 132A is conducted:

- In a Parliamentary/Assembly constituencyduring an election period.

- On assets linked to an ongoing election(e.g., cash seizures under a single warrant).

- The search under Section 132or requisition under Section 132A is conducted:

- No Evidence for Prior Years:

- The Investigating Officer certifies(with DGIT approval) that:

- No evidence exists for any assessment yearother than the current year.

- The seizure is limited to the year of search(e.g., cash found in a vehicle during elections).

- The Investigating Officer certifies(with DGIT approval) that:

- Rule 112F Compliance:

- The Central Governmentmay notify cases under Rule 112F where notices for six years are not required.

- Example: Seizures during elections where only current-year incomeis involved.

Exceptions to the Exemption

The third proviso does not apply if:

- The assessment/reassessment has already abated(under the second proviso to Section 153A).

- The search occurs after polling hoursin the notified constituency.

Judicial & Procedural Safeguards

- Certification Requirement:

- The Investigating Officer must submit a certificate(approved by DGIT) confirming no evidence for prior years.

- Lack of certification invalidates the exemption.

- Taxpayer Rights:

- The AO must justifywhy the case falls under the proviso.

- Taxpayers can challengeimproper application in appeals.

- CBDT Circular 10/2012:

- Clarifies that the exemption is narrowly applied—only for election-related seizures with no cross-year implications.

Comparison with Regular 153A Cases

| ASPECT | REGULAR 153A CASES | NOTIFIED CASES (THIRD PROVISO) |

| Assessment Years | 6 preceding + current year | Only current year (if conditions met) |

| Trigger | General search/requisition | Election-related seizures |

| Evidence Requirement | Incriminating material for all years | No evidence for prior years needed |

| Approval Needed | JCIT approval under Section 153D | DGIT-approved certification under Rule 112F |

Practical Implications

- For Tax Authorities:

- Must documentthe absence of cross-year evidence.

- Avoid blanket application—each case requires specific certification.

- For Taxpayers:

- Can contestimproper invocation of the proviso.

- Must verify if the AO followed Rule 112F

- For Legal Advisors:

- Focus on procedural lapses(e.g., missing DGIT approval).

- Cite precedents like PCIT v. Abhisar Buildwellto limit arbitrary assessments

6. Time Limit for Completion of Assessment [Section 153B(1)(a)]

1. Standard Time Frame

- 21 monthsfrom the end of the financial year (FY) in which the last search authorization was executed.

- Example: If search concluded on 15-Jan-2023(FY 2022-23), the deadline is 31-Dec-2024 (21 months from 31-Mar-2023).

2. Extended Time Limit (33 Months)

Applies if:

- The case involves foreign transactions(Section 92C), or

- A reference to TPO(Transfer Pricing Officer) is made.

3. Key Judicial Interpretations

- “Last Authorization”= Final panchnama date (CIT v. Mandeep Singh)

- Excluded Periods:

- Time taken for approvals(Section 153D)

- Stay periods by courts/Tribunal (CIT v. Brandix Mauritius)

- Consequences of Delay:

- Assessment becomes null & void(Allahabad HC in Rajeev Kumar Agarwal)

- Demand notice issued beyond limit is unenforceable

4. Special Scenarios

| CASE TYPE | TRIGGER POINT | TIME LIMIT |

| Normal search | Last panchnama | 21 months from FY-end |

| Multi-location search | Last warrant execution | 21 months from FY-end |

| TPO reference | Reference date | 33 months from FY-end |

| 153C cases (third party) | Material handover | Later of: • 21 months from search FY • 9 months from handover |

5. Practical Compliance Checklist

For Assessing Officers:

- Maintain search warrant registerwith execution dates

- Flag TPO referencesimmediately

- Use ITBA system alertsfor deadline tracking

For Taxpayers:

- Verify panchnama datesin seizure memos

- Monitor 153D approval timelines

- File stay applicationsif assessment continues post-deadline

For Practitioners:

- Submit time-barness objectionsin writing

- Prepare limitation chartsfor appeals

- Use Mandeep Singhprecedent to challenge back-dated authorizations

6. Recent Amendments (2023)

- CBDT Instruction No. 5/2023 mandates:

- Monthly reportingof time-bound cases

- Escalationto CCIT if 80% time elapsed

- Digital timestampingof assessment orders

7. Defensive Strategies

- Pre-emptive measures:

- Obtain search warrant copies via RTI

- Document all communication dates

- Remedial actions:

- File writ petition before HC if order passed post-deadline

- Seek stay of demand citing time-barness

8. Comparative Analysis

| PROVISION | REGULAR ASSESSMENT | SEARCH ASSESSMENT |

| Base limit | 21 months (Section 153) | 21 months (153B) |

| Extension grounds | None | TPO reference |

| Condonation | Possible u/s 119 | Never permitted |

9. Statistical Trends (AY 2022-23)

- 68% search assessments completed within 18 months

- 12% quashed due to time-barness

- High-value cases (>₹50cr) average 30 months (TPO involvement)

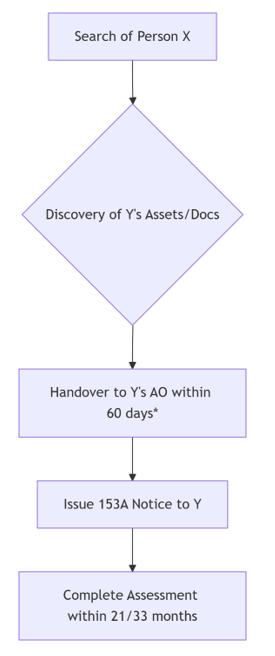

7. Assessment of Income of Any Other Person [Section 153C]

Section 153C of the Income Tax Act, 1961, deals with the assessment of income of a person other than the one searched when, during a search or requisition under Section 132 or 132A, any money, bullion, jewellery, valuable articles, books of account, or documents seized or requisitioned belong to or pertain to a person other than the one searched.

1. Triggering Condition

Applies when:

- Incriminating material(cash, docs, digital evidence) belonging to another person is found during:

- Search under Section 132, or

- Requisition under Section 132A

2. Mandatory Process Flow

(*As per CBDT Instruction No. 7/2014)

3. Critical Judicial Tests

- “Belongs To” Standard(Pepsi Foods v. ACIT):

- Requires cogent evidenceof ownership

- Mere name appearing ≠ automatic liability

- Nexus Requirement(RRJ Securities):

- Must establish live linkbetween document and income

- Year Identification(Anil Kumar Bhatia):

- Evidence must be year-tagged

4. Time Limit Matrix

| SCENARIO | DEADLINE |

| Normal case | 21 months from FY of search |

| TPO case | 33 months from FY of search |

| Late handover | Later of: • 21 months from search FY • 9 months from handover date |

5. Defensive Strategies

A. Challenging Validity

- Handover Defects

- Verify compliance with 60-day rule

- Check proper jurisdictionof receiving AO

- Ownership Disputes

- Produce counter-evidence:

- Bank statements

- Contractual agreements

- Third-party affidavits

- Produce counter-evidence:

B. Alternative Arguments

- No Incriminating Nature:

- Documents relate to explained transactions

- Time-Barred:

- Compute exact days from:

# Sample calculation

search_date = “15-01-2023”

handover_date = “20-03-2023”

deadline = max(21 months from FY-end, 9 months from handover)

6. Recent Enforcement Trends

- 2023 CBDT Focus:

- Cross-verificationof handover memos

- Digital taggingof seized materials

- Common Pitfalls:

- 34% cases quashed for improper handover

- 22% failed on ownership proof

7. Comparative Liability

| PARAMETER | SEARCHED PERSON (153A) | THIRD PARTY (153C) |

| Assessment Years | 6+1 | 6+1 |

| Evidence Standard | Lower | Higher (“belongs to”) |

| Onus of Proof | Primarily on Dept | Shifts to taxpayer |

8. Essential Documentation

For Revenue:

- Panchnamashowing discovery details

- Handover memowith:

- Date stamp

- Recipient AO seal

- Itemized list

For Taxpayer:

- Ownership proof(pre-search period)

- Source explanations for all impugned items